Indicators on Employee Retention Credit 2020 You Should Know

Wiki Article

Facts About Employee Retention Credit 2020 Revealed

Table of ContentsEmployee Retention Credit 2020 Can Be Fun For AnyoneThe 7-Minute Rule for Employee Retention Credit 2020Employee Retention Credit 2020 Can Be Fun For AnyoneFascination About Employee Retention Credit 2020The Of Employee Retention Credit 2020Some Known Incorrect Statements About Employee Retention Credit 2020

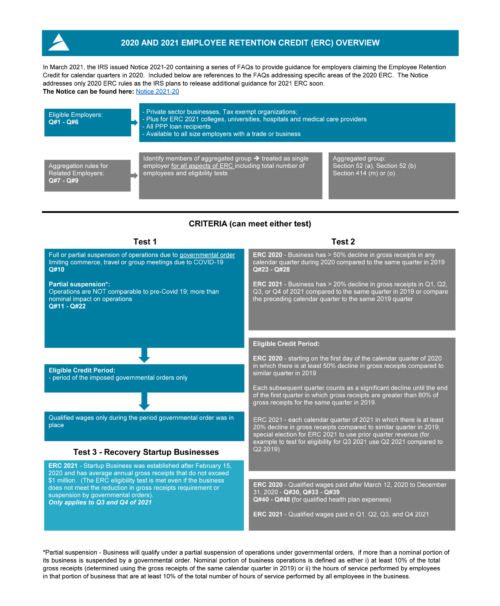

Neither examination would apply in Q4 of 2020, so you would not certify in that quarter. employee retention credit 2020., Credit Rating for Company Differential Wage, as well as Empowerment Area Work Credit Scores.This functions out to an optimum credit of $5,000 per employee through. A certifying period starts in any quarter where invoices are less than 50% of invoices in the exact same quarter in 2019 as well as finishes at the start of the initial schedule quarter after the very first quarter in which gross invoices are more than 80% of gross invoices for that quarter in 2019.

This indicates that the credit report will serve as an overpayment and also be refunded to you after deducting your share of those tax obligations. The table below shows your payroll prices for one full time staff member for 2020 based on 3 competent quarters. The table just consists of FICA tax obligations as an expense given that other costs would certainly not be influenced.

Employee Retention Credit 2020 Can Be Fun For Anyone

This functions out to an optimum credit of $14,000 per employee ($7,000 per quarter) for the period. The credit scores is related to your portion of the worker's Social Safety taxes and also is fully refundable. This suggests that the credit scores will serve as an overpayment and be reimbursed to you after subtracting your share of those taxes.You will certainly make up this credit on Kind 941, which you need to submit by Jan. 31, 2021. You can claim your credit scores by subtracting it from any kind of withholding quantity, including government income tax obligations, staff member FICA taxes, and also your share of FICA taxes for all staff members as much as the quantity of the credit rating.

Also businesses that certified had to fulfill occasionally murky requirements concerning loss of earnings or suspended operations. Subsequent modifications to the ERC that were included in other federal stimulus programs have considerably increased the number of companies that can assert the credit, while also increasing the quantity of cash that can be asserted.

Employee Retention Credit 2020 Fundamentals Explained

If you're unsure whether your service receives the credit rating, this guide will certainly inform you whatever you require to understand about what's readily available with the ERC, just how it functions, just how to qualify, and how to apply. Obtaining a firm understanding of what's available for your organization could assist you conserve 10s of hundreds of dollars this year.It covered certified salaries paid after March 12, 2020, as well as prior to Jan. 1, 2021. Modifications Complying With the CAA and also American Rescue Strategy Here are some of the revisions that were made to the ERC: The ERC's original expiration date of Dec.

Employee Retention Credit 2020 Can Be Fun For Anyone

Company A then got a decision from the SBA forgiving the PPP finance in its whole. The inquiry right here is whether Company A can utilize $80,000 of certified earnings to declare the ERC, since it can have used $80,000 of various other qualified expenditures on its PPP Car Loan Forgiveness Application. The IRS claims no part of the certified earnings reported as payroll expenses can be dealt with as certified salaries for purposes of the ERC - employee retention credit 2020.

Can you declare an ERC if you paid wages that became part of a PPP forgiveness application? As it's currently specified, the very same earnings can not be made use of to claim the ERC as well as additionally support PPP loan forgiveness. Wages included in payroll prices on a PPP Lending Mercy Application as much as the minimum quantity of pay-roll prices needed to sustain lending forgiveness do not certify for the ERC.

Some Known Facts About Employee Retention Credit 2020.

It's clear the federal government's goal is to get funds into the hands of organizations that are using individuals. We are all in a wait and see, but a betting male would certainly position his wager on both mercy & capacity to deduct those costs spent for with ERC funds. Is the ERC Affected by the COVID-19 Economic Injury Disaster Loan? The COVID-19 Economic Injury Catastrophe Finance (EIDL) gives monetary relief to little services as well as nonprofit companies that are experiencing a short-lived loss of profits due to the pandemic.

It is check my blog only readily available to small organizations when the Small company Management determines that business can't get credit score somewhere else. Car loans of approximately $500,000 are available under the EIDL program, with terms as much as three decades as well as dealt with rates of 3. 75% for companies and also 2. 75% for nonprofits.

There is no link between the Worker Retention Credit and the EIDL, so applying for one won't impact your capability to obtain the other. Can You Assert the ERC Retroactively? Yes, companies that receive an ERC under the brand-new policies can claim the credit rating retroactively for 2020. But getting a refund for the credit score could spend some time.

More About Employee Retention Credit 2020

Remember that you will just get a debt on wages paid during the part of why not try these out the quarter business was shut down. For a bit more clarity on how gross receipts vary by year, right here's an appearance at the various pieces of regulations: Under this act, reliable for 2020, an employer would get the ERC if its quarterly gross invoices dropped by greater than 50% from the exact same quarter the previous year.

In the 4th quarter, nevertheless, the company's income climbs by 82% compared to the very same quarter in 2019. The Internal revenue service offers plenty of guidance on just how a company can identify if it endured a partial suspension of procedures due to COVID-19.

Report this wiki page